A reminder from the experts: remember to insure your high-value festive season gifts

The festive season has become synonymous with spending big, particularly when it comes to gifts for family and friends. For those who are lucky enough to be the recipients of the most coveted, big-ticket items, there is a financial aspect of receiving high-value gifts that are often neglected – short-term insurance.

Before diving headfirst into the busy activity of a new year, individuals would do well to achieve peace of mind by insuring their gifts, including electronic devices, jewellery and sports equipment.

This is according to Bertus Visser, Chief Executive of Distribution at PSG Insure who offers the following advice: “Too often, people get caught up in the hype of receiving gifts and don’t stop to think about what would happen if those items get damaged, lost or stolen. Those unfortunate circumstances detract from the joys of receiving gifts so one way to be prepared for the unexpected is to make sure that those items are insured.”

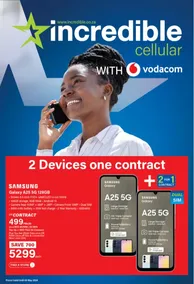

In a recent report by Google, some of the world’s most trending gifts for 2021 included high-value tech items including Apple AirPods and the Sony PlayStation 5, as well as expensive kitchen equipment such as air fryers and coffee machines. As an example, a household that was gifted these items would be in possession of additional goods to the value of over R20 000 – a significant amount of money should those items need to be replaced, and which could mean current insurance cover is insufficient.

“Where short-term insurance is concerned, our advisers encourage individuals to ask questions and empower themselves with the knowledge they need to make informed decisions around their financial security. For example, depending on the value of the item and where it is stored; as well as a myriad of other factors, it may be necessary to insure that item under a separate policy or as part of your household contents insurance. We evaluate everyone’s policy on a case-by-case basis,” explains Visser.

The festive season is also the season for engagements but the euphoria of receiving a ring can sometimes cloud one’s judgement and detract from the importance of making sure that replacement or repair costs are covered. Although there is no way to replace the sentimental value of a ring, short-term insurance can go a long way in offering peace of mind.

“If you’re buying an engagement ring, a great way to round off the purchase is to get it insured – much like you would insure a car before driving it. Getting insurance before gifting the ring will streamline the process because you’ll have all the accompanying paperwork and proof of purchase and ideally, you don’t want to put the responsibility of insuring the ring on the shoulders of the person receiving it,” advises Visser.

One of the aspects consumers are forewarned against is being underinsured. It’s vital for those who take out short-term insurance to consider regular valuations of their household contents and other policies to make sure that the current value of the item is insured and/or that the value of the insurance covers both appreciation and depreciation of goods, depending on the nature of the asset.

As Visser elaborates: “There are quite a few factors to consider when taking out short-term insurance and this is why, again, I encourage consumers to ask questions and get information from professionals who have experience in the field. As insurers, we can advise consumers on all likelihoods because we’re experts at weighing up risks and using data to inform our decisions.”

Depending on the value of the item and various other risk factors involved, your festive gifts; including engagement rings may need separate policies. Alternatively, they can form part of your household contents insurance, in which case it’s important to keep your inventory list updated to ensure that as you and your household grows, you are protected in all eventualities.

Supplied by: PSG Insure / MSL Group.

Guzzle Media