Consumer behaviour and its impact on retail during covid-19

The year 2020 has been unpredictable from a business and social point of view.

The Covid-19 pandemic has caused dramatic shifts in consumer behavioural trends. Who would have predicted that stores would run out of toilet paper due to panic buying in the early days of lockdown, or that hand sanitiser and surgical masks would be the must-have items of 2020?

To make sense of the prevailing retail climate and get a better understanding of how Covid-19 has affected consumers and what their plans are for Black Friday, Guzzle ran a survey to ascertain through engagement with a sample of consumers how Covid-19 has impacted them, how they shop and what their plans are for this Black Friday.

1. How has Covid-19 impacted consumer shopping behaviour?

- 54.3% of the survey respondents are still going out to the shops occasionally although they prefer to do so as little as possible. This makes sense when the survey shows that almost all of the respondents still purchase their food and groceries in-store.

- The top 5 in-store shopping consumers are still most likely to do is:

1. Food & Groceries – 92.9%

2. Beauty Products – 34.3%

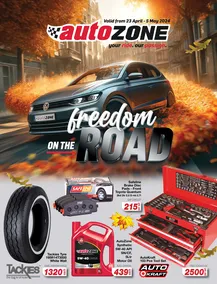

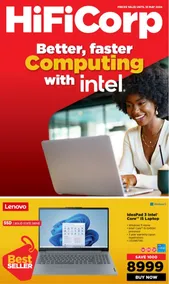

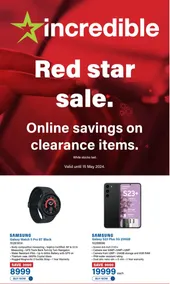

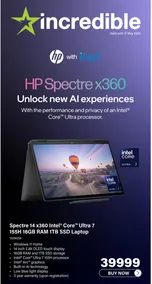

3. Electronics – 30%

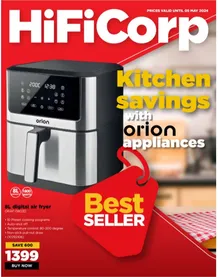

4. Appliances – 28.6%

5. Furniture – 21.4%

- While 57% of the consumers confirmed that they are much more likely to do all their shopping online, we surprisingly see that when asked how they currently feel about visiting their local retailers, 38.6% are indifferent to how safe they felt going out, which was the same as the 38.6% who preferred to avoid going out at all.

- From salary cuts to unemployment, Covid-19 has wreaked havoc not only on the economy, but on many households disposable income in South Africa too. This is apparent where we see that 62.3% of the respondents advised that the pandemic has drastically impacted their income and spending behaviour.

What does consumer shopping look like for Black Friday 2020?

The second part of our survey engaged with the respondents about their shopping plans for Black Friday 2020, both in terms of wants and needs, and how they plan on navigating shops this year:

- The great news is that Black Friday is still a big deal, probably even more so in the current economic climate, with 77.2% of the respondents already having some sort of plan for what they want to purchase this year.

- With 90% of respondents confirming that they like using store catalogues to find specials, Guzzle offers the perfect partnership for retailers to get their Black Friday catalogues in front of as many consumers as possible. Consumer access to the catalogues is vitally important when considering that over 90% have some sort of action plan.

- When asked about specials they would be looking for, we unsurprisingly saw a focus on products that are traditionally popular purchases on Black Friday in SA:

1. Electronics – 65.7%

2. Appliances – 58.6%

3. Food & Groceries – 57.1%

4. Furniture – 44.3%

- High-ticket items are very popular on Black Friday, this is largely due to the very attractive markdowns on these products, where consumers tend to focus even more on luxury item purchases. It’s interesting to note that for the top 3 focusses, Food & Groceries were selected by almost a third of the respondents.

- With the festive season just around the corner, the survey asked what the general feel this year was for how consumers would be gift shopping in the weeks leading up to Christmas. The survey showed a strong positive response where more than a third (33.8%) of people planning to do most of their festive shopping on Black Friday, and a slightly higher percentage (35.3%) saying they would be on the lookout for deals to entice them to purchase.

- With studies showing that females are more likely to participate in online surveys, it’s unsurprising that they made up 62% of the respondents.

- With 62.7% of total engagement with the survey occurring within the 20-39-year-old age demographic, the survey results are in-line with the current consumer behaviour of millennials in 2020. The current retail environment shift definitely favours this generation, as consumers further move to an e-commerce buying space. Millennials are able to easily adapt to this shift as we see more stores explore and strengthen their online presence.

- Retailers need to design services and experiences to meet new consumer needs, as well as increase their investment in the digital sphere while maximising the potential of their store network by reconsidering formats and locations.

- To achieve this, retailers can rely on a reputable internet shopping site like Guzzle to reach a broader market across the country. Guzzle is an aggregation portal which hosts major retailers and assists smaller local retailers in creating digital format catalogues. This provides an easier way of advertising products and promotions while allowing consumers to browse all catalogue promotions in one place. Why does Guzzle do this? So that they support local retailers in addition to saving the consumer time and save cash.

Guzzle Media